More recently, studies have sought to investigate the threshold level for the debt-to-GDP ratio, which identifies the initial point of debt that causes output to fall. Over the years, researchers showed great interest in the relationship between debt and growth by using predominantly causality approaches ( Scott, 1995 Amoateng and Amoako-Adu, 1996 Karagol, 2002). However, when GDP falls, it becomes difficult for governments to raise sufficient revenues to repay debt service obligations. In periods of high debt, policymakers tend to rely on robust economic growth to ensure debt sustainability. Governments may be less willing to undertake difficult and costly policy reforms as this may incur future debt and subsequently hinder technological improvement or the efficient use of resources given the lack of available finances. Output may also be constrained through lower growth in total factor productivity. Therefore, new domestic and foreign investment is discouraged, which slows down capital-stock accumulation.

With a debt-overhang, investors lower their expectations of returns in anticipation of higher taxes needed to repay the debt and may also refrain from investing given the uncertainties about what portion of the debt will actually be serviced with the countries’ own resources. The Caribbean, which has some of the world’s most indebted nations (as a share of GDP) accumulated debt from continuous periods of fiscal deficits since the mid-1990s.Īllowing debt to grow too large can offset the positive impacts 1 and lead to problems in the macro-economy, in particular depressing real GDP growth. High levels of public debt are also an issue facing the region, which have implications for fiscal sustainability and economic growth. In the Caribbean, economic recovery has been sluggish because of strong linkages with the United States and Europe. The current Euro-crisis provides great evidence of the effect high debt levels can have on an economy. With mounting debt service payments due to the inability to raise sufficient capital, the global financial crisis has resulted in serious debt management problems. The mid-2007 global economic crisis had an immense impact on economies throughout the world.

This research enriches the scholarship on regional innovation and lays a theoretical foundation that governments can use in policy development.During economic crises, developing countries tend to accumulate debt as the growth in expenditure levels exceeds that of revenues while capital inflows decline. The regional technological innovation level plays a significant role in promoting regional sustainable development when the former is between 0.301 and 0.438, but regional innovation otherwise has a minimal promotional effect.

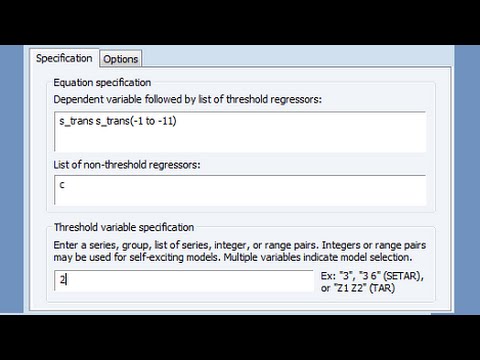

Positive interrelationships are observed between the regional technological innovation level and regional sustainable development when the regional economic development level does not exceed 0.301. The empirical research results show a significant double threshold effect of the regional technological innovation level on regional sustainable development. This paper applies a panel threshold regression model to explore the impact of the regional technological innovation level on regional sustainable development using the regional economic development level as the threshold variable and panel data from 31 Chinese provinces from 2009 to 2015.

0 kommentar(er)

0 kommentar(er)